August 17, 2022

Connor Waldoch, Former Senior Manager, Policy & Regulatory Affairs

Connor Waldoch, Former Senior Manager, Policy & Regulatory Affairs

Connor Waldoch, Former Senior Manager, Policy & Regulatory Affairs

There are already thousands of explainers and new articles on the Inflation Reduction Act (IRA) and at least dozens of attempts to model its impacts. Today, our goal is to leverage the facts of the bill and the best analysis we’ve come across to paint a picture of the implications for our industry and our smart energy technology partners. In thinking through the bill and its promise, we identified three key pillars:

Grid Transformation

How will electric grid change and how do those changes compare to previous estimates? What types of resources are being built and where? What kinds of market products will be necessary to support reliable operation? Where do Leap and our partners sit in this metamorphosis? A review of the short-to-medium term necessities of grid and market evolution.

Consumer and Commercial Incentives

What are the direct impacts to the bottom line for both residential consumers and the C&I businesses that Leap’s technology partners work with? What are those key incentives, whether tax credits or direct pay? How do they apply across technology providers?

Industrial Policy

An overarching theme of the past year of legislation from the Infrastructure Bill, to the Chips and Science Act, and now the IRA has been the resuscitation and reorientation of directed industrial policy in the U.S. What implications does this shift have for Leap, our partners and new businesses in this space? This is the longest-term item here. The implications extend beyond clean energy and are likely to have a continuing impact on the face of manufacturing, trade, and the organization of industry in the U.S. for decades to come.

These are the kinds of questions that drive our review of policy and big-picture strategy for the future of distributed energy resources and connected devices. These are the questions that keep us up at night, wondering what the future might look like. As a singular piece of policy, the IRA does more to get us closer to that envisaged future than anything which came before.

We will explore these concepts over two blog posts. The first will focus on the transformation of energy supply on our electric grid, while the second will review direct incentives and the overarching industrial policy.

The author recently acquired access to OpenAI’s DALL·E 2. The above is an attempt to integrate renewable energy technology into a scene painted in the style of Edward Hopper’s “Nighthawks”.

Grid Transformation

A key facet of the IRA is the extension and broadened support for the deployment of renewable energy technologies.

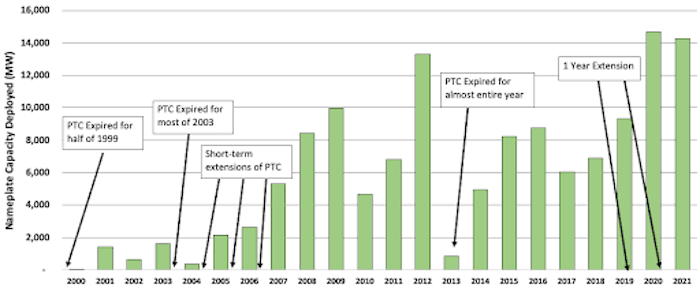

Previously, the ad hoc and often retroactive extensions of the Investment Tax Credit (ITC) and Production Tax Credit (PTC) led to substantial financial uncertainty in certain years and were disruptive to a smooth expansion of the renewable energy industry. Figure 1 illustrates the deployment of wind capacity in the U.S. from 2000 through 2021, with annotations capturing some of the extensions passed by Congress. A meaningful portion of these extensions were passed in December, exacerbating regulatory uncertainty in these industries.

Figure 1. U.S. Wind Nameplate Capacity Additions with PTC Annotations ¹

The IRA extends a decade of certainty to these credits. This certainty should enable the renewable generation mix to evolve more rapidly. As a result, demand-side flexibility solutions will become important to maintain grid reliability. For many power producers, this facet of the IRA provides additional value, surety and flexibility for existing incentives.

It also allows entities without federal tax obligations (nonprofits such as municipal owners of power generation and rural electric cooperatives) to receive the ITC as a direct payment, rather than as a credit against tax appetite. Previously, these generation owners were unable to access the value of these credits and could not develop their own projects.

~10% of generation in the U.S. comes from this corner of the energy world, and increasing their ability to build and own renewable projects should reduce costs for their customers. Nonprofit organizations may have more direct connections to their customers than a traditional utility due to the tighter networks for communities served by rural co-ops, and the simple fact that municipalities represent everything else a town or city provides for its citizens on top of being their utility.

We will leverage our platform, partner ecosystem and market knowledge to help these organizations procure and dispatch a dynamic, two-way energy system to support this new paradigm. We’re not tax experts here, so I’ll leave the detailed synopsis to the actual experts, but these credits should also be easier to transfer for for-profit entities which don’t have sufficient tax appetite, further lowering development costs.

What about the grid as a whole? What sort of national renewable energy deployment numbers are being considered and what are their implications?

The early modeling results from the REPEAT Project, Rhodium Group, Energy Innovation, Resources for the Future and many others all converge towards greatly increased potential for the deployment of renewables, leading to substantially reduced national emissions. How do those results compare to recent modeling baselines, pre-IRA? For this, I turned to the National Renewable Energy Laboratory’s (NREL) Electrification Futures Study (EFS) reports. Per NREL:

“The EFS is specifically designed to examine electric technology advancement and adoption for end uses in the major economic sectors of the United States, electricity consumption growth and load profiles, future power system infrastructure development and operations, and economic and environmental implications of electrification.”

The EFS studies found that increasing demand-side flexibility could generate “up to $10 billion in annual operating cost savings in scenarios with the greatest demand-side flexibility.” This is accomplished by reducing the number of starts and stops at natural gas generators, as well as the number of low-load operating hours at fossil fuel power plants in general. Additionally, the integration of demand-side flexibility substantially reduces the curtailment of renewables under the study’s “high electrification” scenario. This further reduces costs through more efficient operations and reduced deployment needs on the renewable side.

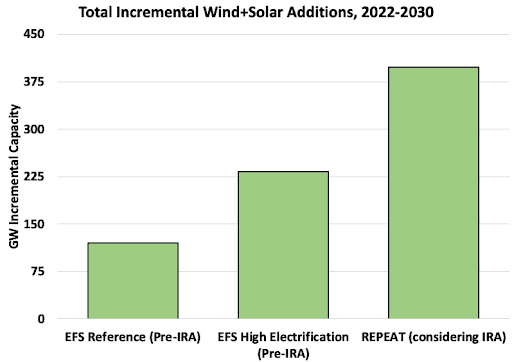

Figure 2 compares three potential outcomes for the incremental deployment of wind and solar capacity from 2022 through 2030. Two outcomes are based on the EFS reference case and their high electrification scenario. The third outcome is based on the REPEAT project’s IRA modeling results.

Figure 2. Incremental Capacity Additions Across NREL and REPEAT Modeling ²

Figure 2 demonstrates the huge potential of the IRA to rapidly transform the electric grid. These early modeling results outstrip renewable deployment in the “high electrification” scenario by more than 150 GW in under a decade.

Unlocking the transactive energy landscape

The potential for a deployment of this magnitude only heightens the need for flexibility across our energy systems, and could help accelerate the adoption of the transactive energy concepts pioneered by Pacific Northwest National Laboratory.

Under a fulsome integration of transactive energy techniques, individual smart devices would be able to transmit their own energy requirements and price points to a “node,” which serves as the interface with the larger energy system. Leap’s goal is to be the interface to these opportunities for our technology partners, presenting turnkey solutions to stack value across different markets to smooth out the bumpy ride as different regions pursue varying implementations.

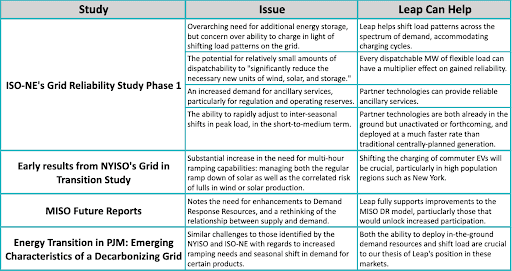

The grid’s future needs aren’t only detailed by federal research institutions. Grid operators themselves have accelerated their study of future conditions as they have observed the last decade of changes. Below is a table showcasing just a handful of recently described challenges at a few market operators, all pre-IRA, but each highlighting an issue Leap can help to address.

Links: ISO-NE, NYISO, MISO, PJM

The above is a small sample of the extent to which market planning already details a growing need for demand-side flexibility, even before a policy like the Inflation Reduction Act was on the books. This bill hits the gas pedal on changes that most markets were already planning for. At Leap, we are looking forward to collaborating with energy markets and our technology partners to bolster grid reliability and unlock new value.

Next time: In part two, we’ll dig into the other two pillars: incentives and the overarching industrial policy at play.

__